It’s a crazy time for small businesses and people who are self-employed. While some small businesses are seeing their revenue streams dry up (hopefully temporarily), others are scrambling to keep up with new demands and an opportunity for growth. Depending on your industry—whether Mid Century Modern design or anything else—it’s possible that you’l actually grow your business or free-lance work during this hard economic time. And we’ve got resources for you: help through this freelancer and small business COVID-19 round-up.

But sorting through the myriad of coronavirus-related resources to get exactly what you need can feel like searching for a needle in a haystack. Especially because there, as a small-business owner, there are plenty of other things vying for your attention too. To help you out, our Atomic Ranch team has put together this round-up of resources with a list of handy links. We love to support the mid mod community, and small business COVID-19 resources are right here so you can bookmark and refer to them for easy access.

Federal Loans and Grants

On March 27, President Trump signed a $2 trillion Coronavirus Aid, Relief, and Economic Security Act into law. That’s a big name, so it’s also called the CARES Act. You can read the full act here.

Did you know that small businesses employ 48 percent of Americans? Helping small businesses also means helping Americans, and Congress knows this. That’s why they’ve marked out $349 billion of that $2 trillion for small business loans, which will be backed by the U.S. Small Business Administration (SBA). These loans will help small businesses make essential payments such as payroll, rent and utilities. Some loans would convert to grants that you don’t repay, as long as you meet certain conditions (though you’ll want to read those conditions carefully before applying). These new loans are different from the regular SBA loans small businesses already know about. The differences are explained by Inc. here.

To help workers and business owners navigate this new system, the Chamber of Commerce has prepared this checklist. This will help you understand and apply for the COVID-19-related SBA loans.

Self-Employed Workers

Independent contractors aren’t usually eligible for unemployment. However, if you’re a freelancer and you’re getting fewer gigs, you might temporarily be eligible for unemployment benefits. You can find out how it works with this Business Insider article. Another place to get help is at this CareerOneStop.org link for information and applications on unemployment benefits in various states.

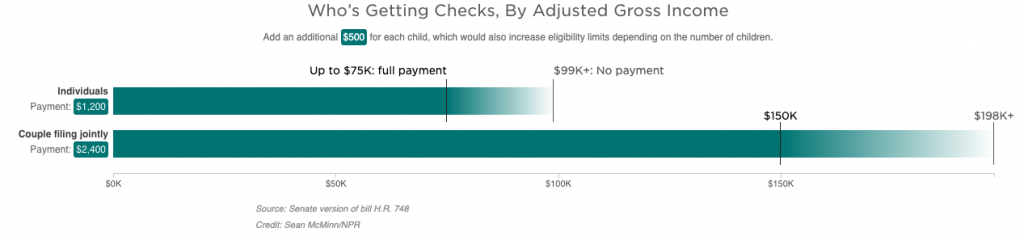

One-Time Relief Checks

Because of the COVID-19 drop in the economy, some Americans will receive one-time checks for $1,200. You don’t ned to apply for these funds—eligible workers will receive checks in about three weeks, according to this article.

Admittedly, 2019 already seems like a million years ago. If you can’t remember your adjusted gross income for 2019, it’s on Line 8b of your 1040 federal tax return, according to the New York Times.

Big Business to Small Business COVID-19

Larger businesses are also working to help small businesses stay solvent. Check out this list from Entrepreneur of at least 65 products and services related to technology that are free during the pandemic. (They’ll continue to update the list as things change.)

Similarly, Inc. has compiled its own list, as well as a small business survival guide to help you navigate your small business, COVID-19 style.